In the last quarter, the smartphone market has sunk by 12 percent. This has led to a dramatic decrease in the number of people updating their phones and is predicted to have serious knock-on effects for manufacturers and carriers. The industry is about to enter a period of price wars and discounts as manufacturers compete for consumers in an effort to shift unsold inventories.

The pandemic caused a multitude of issues for the smartphone market. Chips that power handsets were scarred between as manufacturers temporarily closed to help stop the spread of the virus. This not only caused a shortage in smartphone handsets but also in cars and other electronic goods like laptops.

New data from Current Analysis suggests that the dramatic drop in smartphone sales is due to a lack of innovation and an increasing reliance on feature phones by carriers. Sales of all mobile phones dropped by 15% across the world, in comparison to a rise of 3% for tablets and 1% for PCs. In the US, there was a 19% drop in sales as people stayed on their phones for longer. Globally, smartphone sales are down from 488 million units to 429 million units.

This is bad news for all of the smartphone manufacturers who have been hoping for a fruitful Christmas season to see their sales and plans to increase market share. While last year saw record sales and a boom in smartphone usage, this can be attributed to the fact that the majority of us had just bought a new phone, and the novelty had worn off by now.

What’s even more troubling is that this dip in smartphone sales is not expected to rise until 2030. The smartphone market is, in fact, expected to increase by a mere 1.6% from this time on.

“The smartphone industry has reached saturation in most markets, and carriers are introducing new services and device price points aimed at maintaining their market share,” said David Hsieh, analyst for Current Analysis. “Smartphones are also becoming less essential in some markets as 2015 progresses and a growing focus shifts to the premium smartphone class.

China will be more likely to experience a “halo effect” than other markets across Asia, as this is where all new smartphones are sold, and increased smartphone penetration contributes to wider adoption.

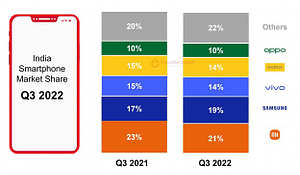

Curiously, the smartphone market is expected to reach saturation in India at around the same time as most other markets, so there will be no sudden shift in growth. In fact, India’s smartphone penetration rate is much lower than other markets due to its low usage of high-end smartphones costing thousands of dollars and having many limitations in terms of data services and devices available.

(Image source: GSM Arena News)

“The slowdown in smartphone growth is largely coming from Huawei and Apple, who have dramatically slowed their market share growth as they launch new products or refresh existing ones.” Samsung has done particularly well this year, even though it has had its fair share of hiccups. But all hope for the Korean company’s increasing market share will be crushed if it does not launch its all-new Galaxy range in 2023, especially as Apple has overtaken them in market share in China.

However, these issues are set to be resolved in the next two years, meaning a sudden boost in demand and an increase in market share. China’s growth is expected to increase by over three percentage points from last year, from 97% to just under 100%. Conversely, Russia’s figure will plummet from 93% to around 89%.

The future for Android and iOS is looking rather glum at the moment, as there seems to be no innovation or change in their systems. Carriers and manufacturers are also putting their foot down on the pricing of new phones, which is causing some consumers to be put off by the higher costs of upgrading. There is also the threat of Elon Musk potentially developing his own smartphone, which will be of concern to the other tech giants, increasing competition and also the threat of new technology.